Please fill out the form below if you have a plan or project in mind that you'd like to share with us.

CIBIL (Credit Information Bureau India Limited) Verification API helps businesses quickly assess the creditworthiness of individuals and organizations by providing secure access to credit scores and reports from CIBIL. As one of India’s leading credit bureaus, CIBIL maintains comprehensive credit data that helps in accurate risk evaluation.

With seamless API integration, businesses can verify credit history in real time and make informed decisions before offering loans or financial services.

Softzix CIBIL Verification API helps businesses access and verify credit information securely, enabling smarter lending decisions and risk assessment.

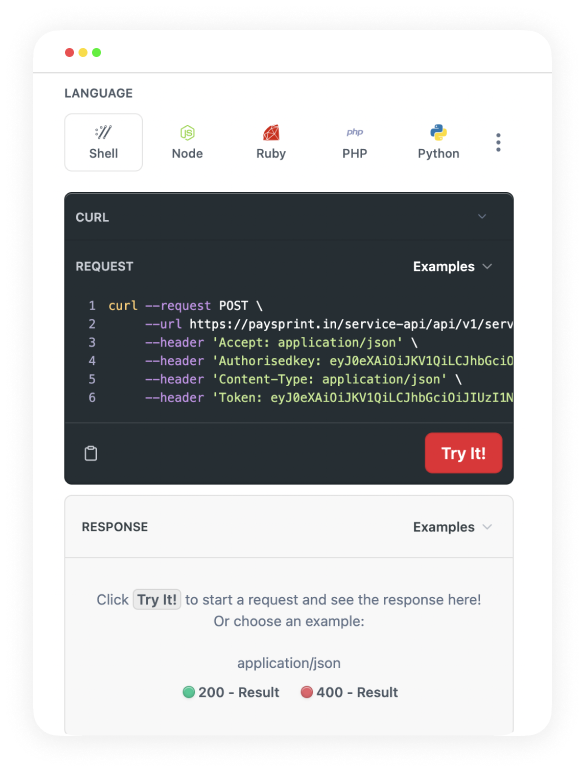

Well-documented and flexible APIs for easy and secure integration.

Integrate flight services quickly with minimal development effort.

Completely digital onboarding with quick approvals.

Expert technical assistance at every stage of integration.

Monitor APIs, transactions, and reports from one dashboard.

Ready-to-use APIs compatible across platforms.

Manage multiple API services using a single wallet.

Enterprise-grade security with scalable infrastructure.

Verify credit scores instantly and access detailed insights to make informed lending decisions.

Collect user info and digital consent securely.

Retrieve real-time scores and credit reports instantly.

Get structured results for automated credit assessment.

Softzix Flight API is built for developers by developers. With clean REST endpoints, structured JSON responses, and ready-to-use SDKs, you can integrate and launch your booking portal seamlessly in record time.

Instantly verify credit scores and reports with Softzix CIBIL Verification API — fast, secure, and fully automated for smooth financial onboarding.

Access CIBIL scores instantly to evaluate creditworthiness efficiently.

All credit verifications follow regulatory standards for safe financial assessments.

Receive real-time credit reports for faster decision-making.

Access reliable credit data to prevent risk and improve lending decisions.